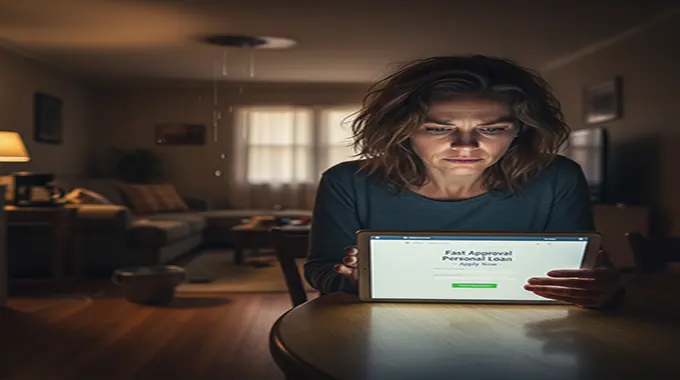

Life is unpredictable, and when a financial emergency hits—be it an urgent medical bill, a sudden car repair, or an unexpected home disaster—time is of the essence. Waiting days for a traditional bank loan decision is simply not an option. This urgency has fueled the rise of the fast approval personal loans for emergencies online, a product designed for speed, convenience, and rapid access to cash.

The Digital Advantage: Why Online Loans are Faster

The core advantage of seeking an emergency loan online is the elimination of manual, paper-based processes. Modern online lenders, including banks, credit unions, and dedicated FinTech platforms, have streamlined the lending process into a few quick digital steps:

- Instant Pre-Qualification: Many online lenders allow applicants to pre-qualify by entering basic information. This step involves a “soft” credit pull, which does not affect your credit score, and provides an instant rate estimate.

- Paperless Application: The formal application is completed entirely online, often requiring applicants to securely upload digital copies of documents (such as ID, proof of income, and bank statements).

- Algorithmic Approval: Using advanced algorithms, lenders can instantly analyze an applicant’s creditworthiness, income, and debt-to-income ratio. This automated review can result in a loan decision in a matter of minutes.

- Rapid Disbursal: The primary appeal for emergencies is the speed of funding. Once approved and the loan agreement is signed digitally, funds can often be transferred to your bank account as soon as the same business day or the next business day.

Key Features of Emergency Online Personal Loans

These loans are typically unsecured, meaning they do not require collateral (like a house or car), which further speeds up the approval process. They offer a fixed interest rate and a predictable monthly payment schedule, providing stability during a stressful time.

| Feature | Benefit for Emergencies |

| Unsecured | No need for collateral; faster process. |

| Fixed Rate | Predictable monthly payments, easier budgeting. |

| Flexible Use | Can be used for almost any urgent expense (medical, auto, home). |

| Fast Funding | Funds available within 24-48 hours of approval. |

How to Improve Your Chances for Quick Approval

While the online process is quick, a successful application still hinges on key financial factors. To ensure the fastest possible approval, prepare the following:

- Check Your Credit: A stronger credit score generally leads to faster approval and a lower interest rate. A score of “Good” (often 670+) is ideal for the best terms, though many online lenders cater to “Fair” credit borrowers as well.

- Verify Your Income: Have your latest pay stubs or bank statements ready to clearly demonstrate a stable, verifiable income. This is crucial as it reassures the lender of your ability to repay the loan.

- Confirm Eligibility: Review the lender’s minimum eligibility requirements (age, residency, and minimum income) before applying to avoid delays.

- Pre-Qualify First: Always use the pre-qualification tool offered by lenders to see potential rates without a credit score impact. This allows you to shop around for the best deal efficiently.

A Word of Caution: Comparing Options

The rush of an emergency can lead borrowers to accept the first offer they receive. However, it is vital to remember that a fast approval personal loan is still a serious financial commitment.

Be sure to compare the Annual Percentage Rate (APR), which includes both the interest rate and any fees. While speed is critical, the difference of a few percentage points on the APR can save you hundreds, or even thousands, of dollars over the life of the loan. Always read the fine print regarding origination fees, late payment penalties, and prepayment penalties before you sign.

In a crisis, fast approval personal loans for emergencies online serve as a necessary lifeline, transforming a process that once took weeks into one that takes mere hours, allowing individuals to quickly address urgent financial needs and regain stability.