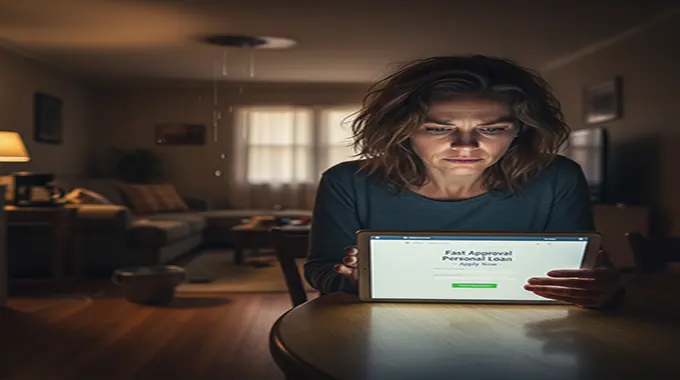

When Disaster Strikes: Securing Fast Approval Personal Loans for Emergencies Online

Life is unpredictable, and when a financial emergency hits—be it an urgent medical bill, a sudden car repair, or an unexpected home disaster—time is of the essence. Waiting days for a traditional bank loan decision is simply not an option. This urgency has fueled the rise of the fast approval personal loans for emergencies online, a product designed for speed, convenience, and rapid access to cash.

The Digital Advantage: Why Online Loans are Faster

The core advantage of seeking an emergency loan online is the elimination of manual, paper-based processes. Modern online lenders, including banks, credit unions, and dedicated FinTech platforms, have streamlined the lending process into a few quick digital steps:

- Instant Pre-Qualification: Many online lenders allow applicants to pre-qualify by entering basic information. This step involves a “soft” credit pull, which does not affect your credit score, and provides an instant rate estimate.

- Paperless Application: The formal