Private Equity Fund: Capital Funding Sources for Small Businesses

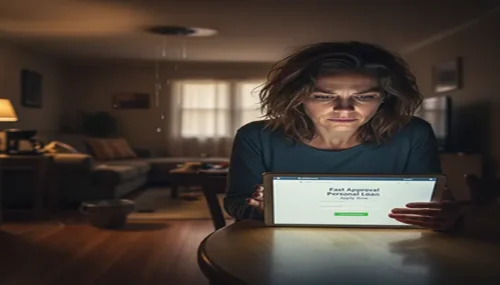

If your organization needs cash to go forward, you might want to head for some alternate-ideal financing options or face the potential for having no enterprise in any respect. The methods listed below on capital funding is probably not what your accountant would advise you to do, however, they will raise cash to suit your needs in case you are in a business need.

Sell Your Assets

Lots of small business proprietors overlook the sale of assets to raise investment capital funding for cash quickly. While it may not be ideal to sell your automobile and lease one which can cost you more in the end, it might be to your business will survive. Private equity fund resources are a way to release capital for a company immediately.

Borrow Against the Cash Value of Your Life Insurance or Factor Receivables

You could only borrow against a complete life policy, not …