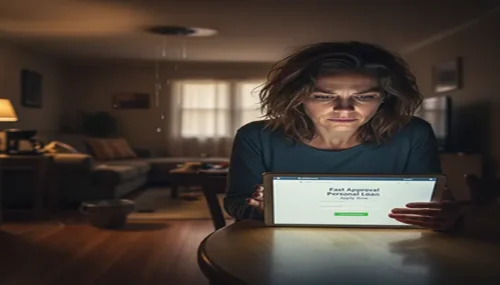

Be Alert For Investment Opportunities To Help Your Cash Grow

Whether you are the borrower or the lender it is vital that you have some sort of investment opportunities in place. The way that money goes in one hand out the other is very different than it was a long time ago. You were not given many choices at that time except to go through a loan agency to get a loan. There is no other place for you to get a loan except through a bank and if you do not qualify, then there is no other alternative.

Great Investment Opportunities

Now you have a lot of great investment opportunities that you can follow. It’s very difficult to get a loan and everywhere you see people being turned down everywhere. Perhaps it is because they messed up their credit when they were younger. There is always someone out there willing to give you a loan if you meet their …