There a wide range of firms that are offering to you debt consolidation loan solutions for those who have poor credit. Many consumers have no idea where you should look for help with the economic chaos hitting everyone so hard. If you have poor credit and you are looking for a debt consolidation loan you will discover one. While there are many legitimate companies out there that will help you locate a loan for debt consolidation loan there are a few firms that aren’t legitimate and could worsen your situation. Before you jump in a loan using a company you should take several steps to ensure you don’t end up in a gimmick.

The most important thing that you must know maybe the varieties of loans or services which can be found. Knowing what types of loans and services you will come across may help be sure you pick the best one to your specific situation.

One type of home loan that you will come across is a debt negotiation loan and this is known as the debt negotiation loan. The companies that offer these services will accept handle your debts by negotiating better interest levels with lenders. This can be a great way to handle your finances and obtain a lesser interest rate. However, you need to be mindful as some companies will need your dollars and could even if it just contacts the lenders. This can be a major problem which can lead you to have some additional fees as well as your creditors might seek collections.

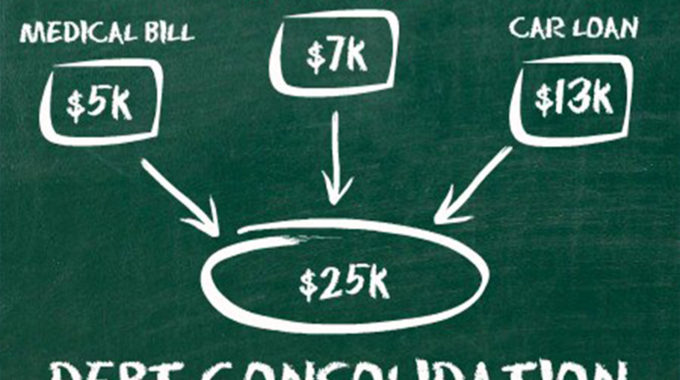

The second type of mortgage you probably will encounter can be a debt consolidation loan. A consolidation loan can be a loan that you can have all of the money you owe combined into one loan. This will allow you to have one payment every month. However, the downside to this is how the company will often charge a fee and quite often an interest that belongs to them. This can lead you to have to pay a decent amount of money for your consolidation loan.

Finally, you may also encounter a debt elimination loan. This type of service can be a very shady service as companies will charge which you fee then give you a document stating why that line of credit is just not legitimate. This is one type of service that you must avoid without exceptions because you might end up in a very potentially bad situation.

If under consideration under-going an organization you might want to try to contact your lenders yourself. You may be able to work out something together when you invest your dollars into other types of service. If you decide to obtain a credit card debt consolidation reduction loan then you ought to research on the web and the Better Business Bureau extensively to ensure that you aren’t working with a bad company. You can also attempt to get yourself a loan in the bank or ask a banker for the recommendation. Even if the bank can’t give which you loan the banker can help you locate a solution to your problem. You should always keep in mind that if a debt consolidation loan sounds too good that you must investigate it further so that it’s a legitimate deal.