Tesla Inc’s net loss widened to $740 million in the second quarter, as it spent heavily to remain a leader in electric vehicles. Tesla said it expected another quarterly loss as it ramps production of its first mass-market car, the Model 3. Tesla reported a $784.6 million net loss for the three months ended June 30 compared with a loss of $336.4 million in the same period last year, surpassing analyst expectations for a loss of $600 million, according to Thomson Reuters I/B/E/S

Tesla Inc’s net loss widened to $740.0 million in the second quarter, as it spent heavily to remain a leader in electric vehicles.

Tesla Inc’s net loss widened to $740.0 million in the second quarter, as it spent heavily to remain a leader in electric vehicles.

The company said on Wednesday its cash balance at June 30 was $2 billion, down from $3 billion at the end of March. It ended the quarter with about $8 billion in debt and obligations of about $9 billion including options and warrants on which it could owe money if exercised by others.

Tesla said it expects capital expenditures for 2019 to be about $2 billion higher than previously guided due to new product development costs related to Model Y crossover vehicle production launch later this year; Gigafactory 1 expansion activities; tooling for Model 3 production capacity increase; and continued investments in Tesla Energy products (Powerwall 2/Powerpack 2).

Tesla said it expected another quarterly loss as it ramps production of its first mass-market car, the Model 3.

Tesla Inc’s first mass-market car, the Model 3, began production in July. The company said it expected another quarterly loss as it ramps production of its first mass-market car, the Model 3.

Tesla said on Wednesday it would remain cash flow positive with Model 3 production at 5,000 per week by late August and with higher volume than that by September.

In its second quarter financial results released after U.S. markets closed on Wednesday night, Tesla said it spent heavily to remain a leader in electric vehicles (EVs).

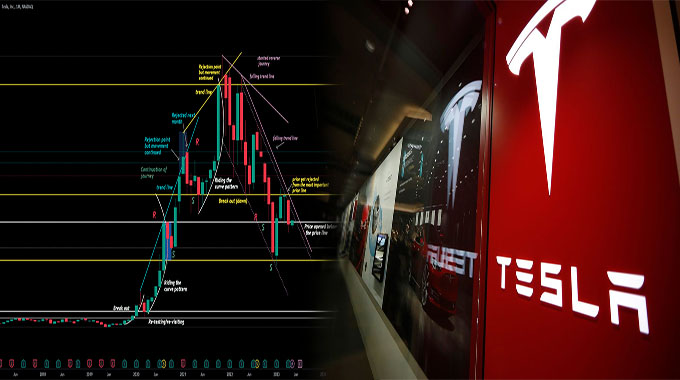

Tesla reported a $784.6 million net loss for the three months ended June 30 compared with a loss of $336.4 million in the same period last year, surpassing analyst expectations for a loss of $600 million, according to Thomson Reuters I/B/E/S.

Tesla Inc reported a $784.6 million net loss for the three months ended June 30 compared with a loss of $336.4 million in the same period last year, surpassing analyst expectations for a loss of $600 million, according to Thomson Reuters I/B/E/S.

The electric carmaker’s revenue grew to $6.8 billion in the second quarter from $4.0 billion a year earlier. Its net loss was narrower than the $900 million loss that analysts had expected, according to Refinitiv data.- Tesla Inc (TSLA) : Tesla Reports Second Quarter 2019 Results; Q3 Guidance Raised

The company’s shares plummeted 16% on Thursday after announcing earnings that fell short of Wall Street expectations, giving up some gains since hitting an all-time high earlier this month.

Tesla Inc’s shares plummeted 16% on Thursday after announcing earnings that fell short of Wall Street expectations, giving up some gains since hitting an all-time high earlier this month.

Shares in the electric car maker fell $10.40 to close at $300.60 after it reported a second-quarter loss per share of $2.90, compared with a profit of $1.44 for the same period last year and below analysts’ average estimate of a loss of 1 cent per share, according to Refinitiv data.”The biggest surprise was the magnitude of the miss,” said analyst Max Warburton at Sanford C Bernstein & Co in New York City.”We need Tesla to get back on track quickly or else its valuation will come under pressure again.”

The electric vehicle maker said capital investments at its Fremont plant will total more than $2 billion this year and come close to $3 billion in 2019..

Tesla’s net loss widened to $740.0 million in the second quarter, as it spent heavily to remain a leader in electric vehicles.

Tesla said it expected another quarterly loss as it ramps production of its first mass-market car, the Model 3. A wider loss would mark Tesla’s third straight quarter of unprofitability and challenge Chief Executive Elon Musk’s prediction that Tesla would be profitable from now on through 2020.

The company said capital investments at its Fremont plant will total more than $2 billion this year and come close to $3 billion in 2019..

Earnings are a measure of how many dollars a company is taking in versus how many dollars they’re spending or investing

Earnings are a measure of how many dollars a company is taking in versus how many dollars they’re spending or investing. Earnings are the primary way investors evaluate the success of a company, as well as its ability to continue generating revenue and profits in future quarters.

Tesla shares fell by almost 16% in after-hours trading Thursday after the company reported second-quarter earnings that were well below Wall Street expectations and gave up some gains since hitting an all-time high earlier this month.