Life After Student Loans

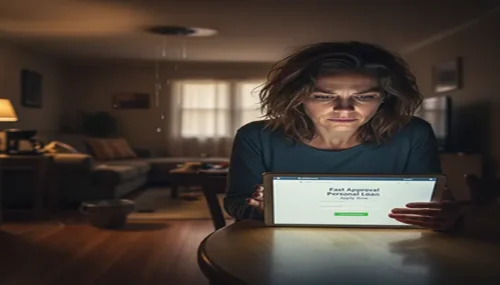

If you’re in your 20s or 30s, you might be wondering how much student loan debt will affect your retirement years. It’s a good question to ask! After all, if you’re still struggling with student loans as an adult, it could impact your ability to save for retirement and other long-term goals. That’s why we’ll explain how paying off student loans early can help improve your financial situation later on down the road — starting with how much it would be worth for you if you paid off $100K in student loan debt today!

There are many benefits to paying off your student loans ahead of time.

There are many benefits to paying off your student loans ahead of time. First and foremost, you’ll have more money in your pocket. If you’re paying $600 per month on a student loan with an interest rate of 6%, then that means for …