Being Prepared Will Make The Mortgage Loan Application Much Easier

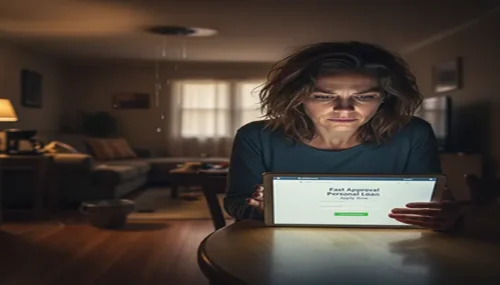

Purchasing a house for the first time should be an exciting and happy moment however the process of obtaining one can be difficult and anxiety-provoking. Like most things in life, preparation makes everything much easier and having your finances in order and documents prepared ahead of time will definitely simplify the process. Important issues that need to be addressed beforehand include building a solid and stable work history, writing a personal budget, getting a copy of your personal credit report and reviewing it for inaccurate items and setting aside enough money for the down payment for your residence in the future.

Credit Report

It’s important to get a copy of your credit report from each of the three credit reporting bureaus; Transunion, Equifax, and Experian. Read each item and note the differences and errors. If there are inaccuracies, you can dispute them and this must be done with each of …