You see the ads on TV and hear them all day on the radio asking if you know your credit score. They all want you to use their service and get copies of your credit report and score. But is it really necessary? Do you really need to know your FICO score? Here’s a closer look…

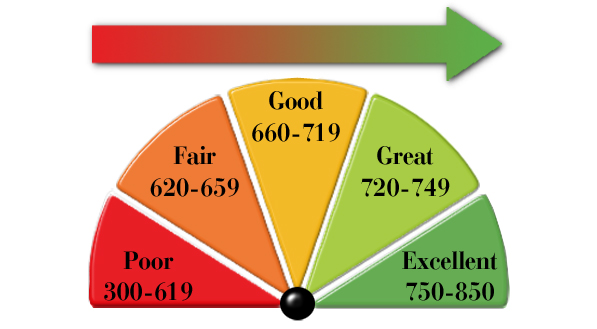

If you have any kind of credit history at all, either through credit cards, loans, mortgages, etc., then you will also have a credit score. These scores will range from a low of 300 all the up to 850. Naturally, the higher the numbers the better.

Your scores are used by lenders and other financial companies to determine whether or not you qualify for things such as a new car loan, a credit card, a lease on that new apartment, or even a new job you have applied for.

Yes, employers have the right to pull your credit history as part of their pre-screening process for anyone applying for a job. Not all do, but all have the right to do it, and many do!

Knowing upfront exactly what your credit score is will help you know if it is even worthwhile to apply for a loan or other transaction. Obviously, if your credit is poor and you try to apply for a new 6% 30 year mortgage, chances are it isn’t going to happen. Better to know upfront how your credit looks than to be “surprised and embarrassed” later on.

Another great reason to know your score ahead of time is that it gives you the ability to begin making changes to your credit history. You can clean up your credit before trying to make that new loan.

You’ll also be able to look at your report and see if there are any errors or information on it that shouldn’t be. If so, you have the right to dispute it and have it removed. But this takes a few months to complete. That’s why you want to know what your credit report looks like ahead of time, so you can get started making the changes necessary.

These two reasons alone are why it is always a good idea to get an annual copy of your credit report and score once a year. The good news is that the report is free of charge once a year. The score will cost you a small extra amount, but it is well worth it. If you haven’t requested a copy of your credit history in the last year or more, I would urge you to do it while you’re thinking about it right now.