Best Strategies for Managing Household Debt Effectively

Household debt is a common challenge that many individuals and families face. However, with the right strategies and proactive approach, you can effectively manage and reduce your debt burden. Here are some of the best strategies for managing household debt effectively:

1. Assess Your Debt Situation

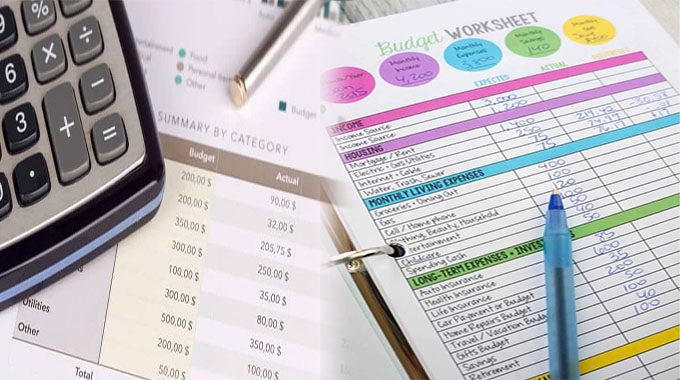

The first step in managing household debt is to assess your current financial situation. Gather all your debt statements, including credit cards, loans, and mortgages, and calculate the total amount of debt you owe. Take note of the interest rates, minimum payments, and due dates for each debt to prioritize your repayment strategy.

2. Create a Repayment Plan

Develop a repayment plan that outlines how you will tackle your debts systematically. Consider using the debt snowball method or the debt avalanche method to prioritize your debts based on either smallest balance or highest interest rate, respectively. Set realistic repayment goals and allocate a specific …